Renters Insurance in and around Madison

Welcome, home & apartment renters of Madison!

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Hanover, IN

- Madison, IN

- Jefferson County, IN

Protecting What You Own In Your Rental Home

Think about all the stuff you own, from your laptop to desk to bedding to children's toys. It adds up! These valuables could need protection too. For renters insurance with State Farm, you've come to the right place.

Welcome, home & apartment renters of Madison!

Renting a home? Insure what you own.

Why Renters In Madison Choose State Farm

When renting makes the most sense for you, State Farm can help cover what you do own. State Farm agent Josh Denny can help you develop a policy for when the unpredictable, like a fire or an accident, affects your personal belongings.

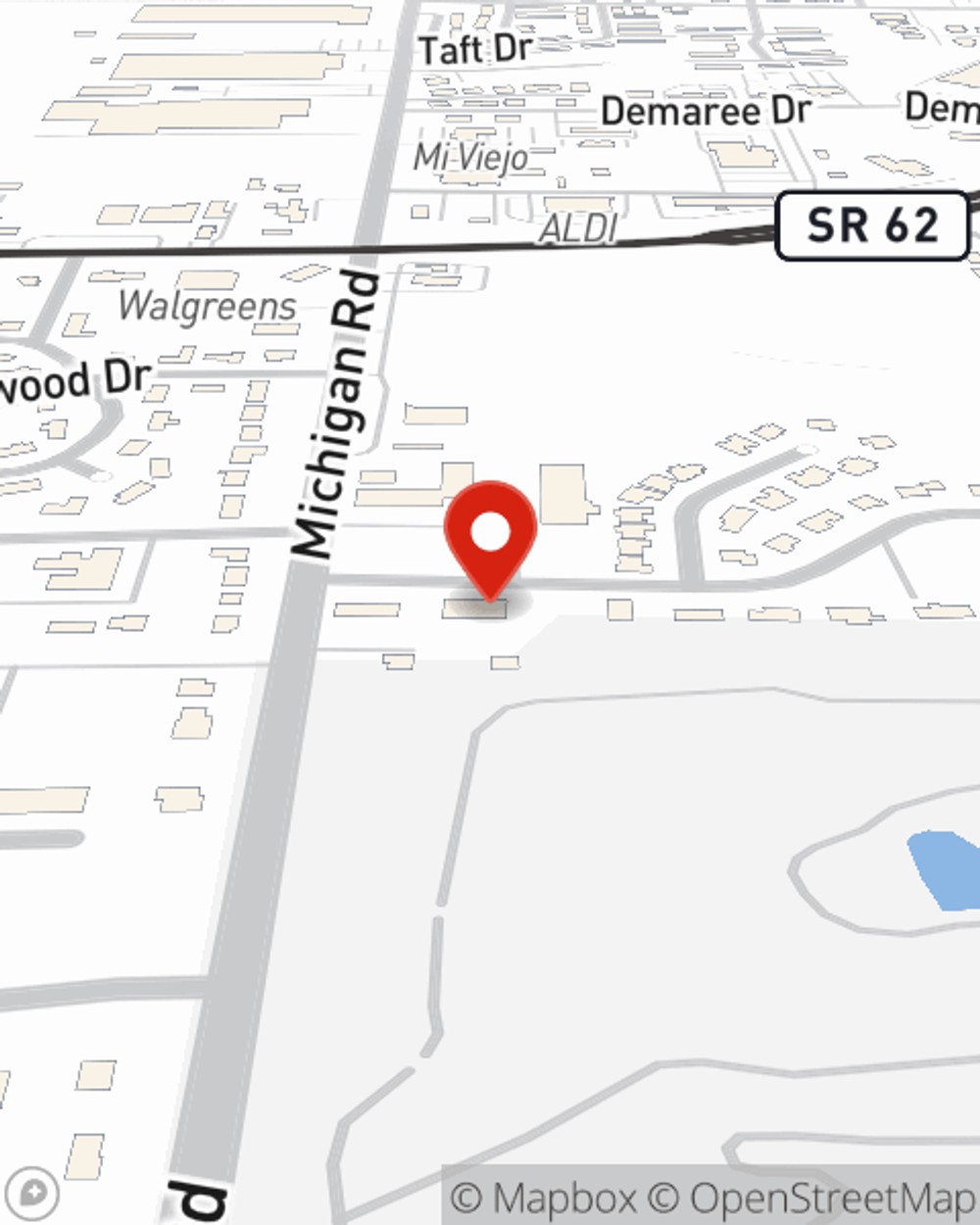

There's no better time than the present! Visit Josh Denny's office today to help make life go right in your rented home.

Have More Questions About Renters Insurance?

Call Josh at (812) 265-6601 or visit our FAQ page.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.